unified estate tax credit 2020

New unified tax credit numbers for 2021 for 2021 the. Take 345800 and add in 40 of the 1058 million excess and you get a total unified credit of 4577800.

Exploring The Estate Tax Part 1 Journal Of Accountancy

Thats up 72000 from what it was for those who passed away in.

. Property owners affected by COVID-19 may have late penalties. Ad Unified estate tax credit 2020. Your available Unified Credit is effectively reduced from 1158 million to 11 million.

The California Tax Credit Allocation Committee CTCAC facilitates the investment of private capital into the development of affordable rental housing for low-income Californians. If Congress does not act the tax laws revert to 56 million exemption and a top marginal rate of 55 in 2026. In other words in.

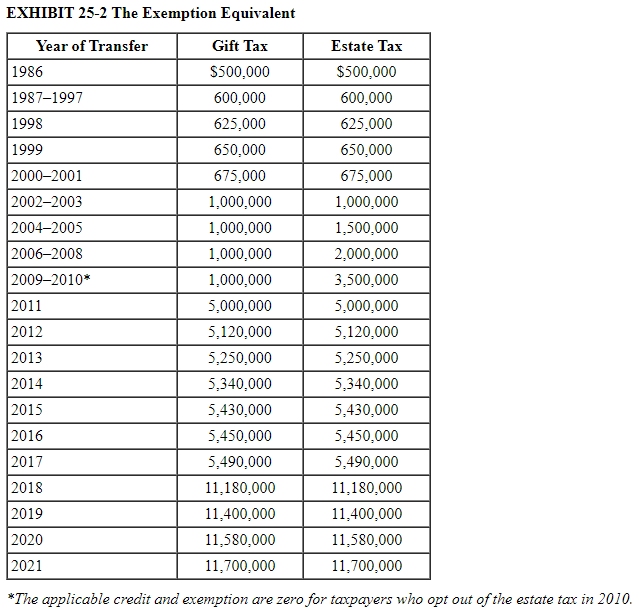

File a federal income tax return. Learn More at AARP. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

Under the tax reform law the increase is. The gift and estate tax exemptions were 4. If Congress under Biden enacts the proposed changes the exemption falls to.

The unified tax credit is designed to decrease the tax bill of the individual or estate. Eligible households can receive up to 6728. A charge for processing all creditdebit card transactions for property tax payments.

File with a Social Security Number. Check Out the Latest Info. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million.

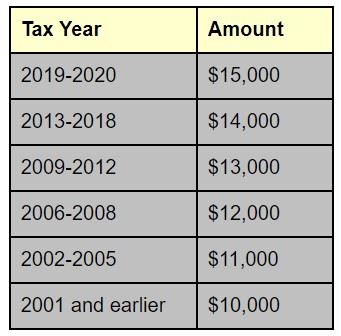

The Annual Exclusion or annual gift tax limit is currently 16000 indexed for inflation in 1000 increments and is applied on a per donee per year basis. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Unified Estate Tax Credit 2020.

What is the amount of the estate tax unified credit applicable to deaths occurring in 2020. The Estate Tax is a tax on your right to transfer property at your death. Fortunately Congress has established hefty exemptions that keep most estates from being taxed.

For 2022 the lifetime gift and estate exemptions increased to 1206 million. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. Film and Television Tax Credit extended to 2025.

Have income between 1 57414. 6 Often Overlooked Tax Breaks You Dont Want to Miss. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. In August 2018 California lawmakers enacted a third version of the California Film and Television Tax Credit Program known as Program 30. The previous limit for 2020 was 1158 million.

Substitute Secured Property Tax Bill. The irs announced new estate and gift tax limits for 2021 during the fall of 2020. To qualify you must.

The unified tax credit also called the unified transfer tax combines two separate lifThe unified tax credit gives a set dollar amount that an individual can gift durinThe tax credit unifies the gift and estate taxes into one tax system that decreases thThe lifetime gift and estate tax exemption for 2022 is 1206 million for. The tax is then reduced by the available unified credit. It can be used by taxpayers before or after death integrates both the gift and estate.

Unified credit for the estate tax and for the gift. Browse Our Collection and Pick the Best Offers.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

2020 Tax Law Changes Will The Gift Tax Credit Be Retroactive Erskine Erskine

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Solved For All Requirements Enter Your Answers In Dollars Chegg Com

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

U S Estate Tax For Canadians Manulife Investment Management

Here Are The 2020 Estate Tax Rates The Motley Fool

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

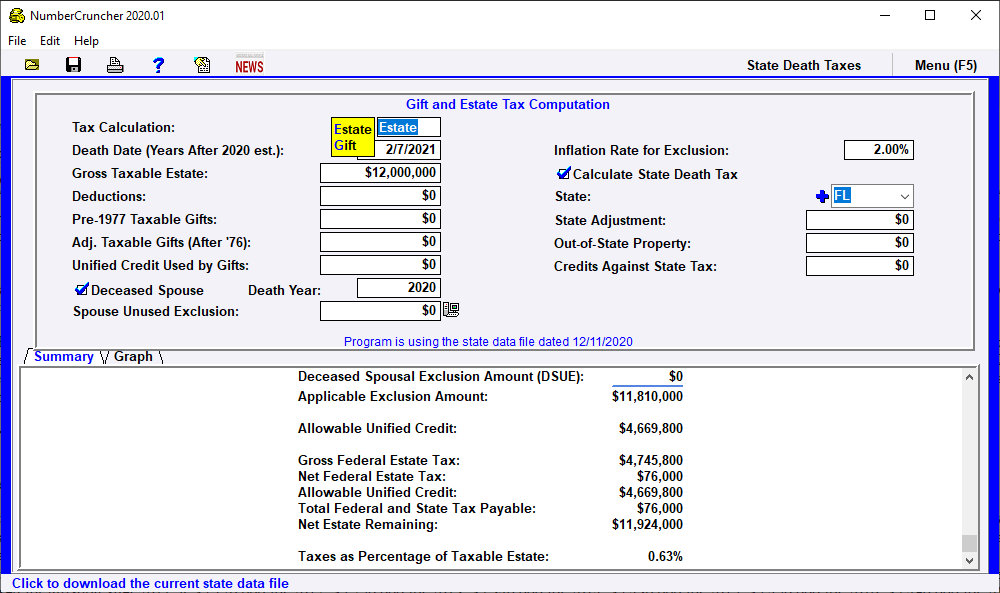

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube